Standard Cost Labor Rate . It is computed by multiplying. Let’s begin by determining the standard cost of direct labor for the good output produced in january 2023: Standard costing is the cost accounting method that determines the expected cost for each product as a part of production planning or. Assuming that the actual direct. The standard cost of direct labor is the total cost of labor required to produce a unit of a product or provide a service. The standard quantity is the expected usage amount of. The standard cost is an expected amount paid for materials costs or labor rates. Fixed overhead is allocated to the cost of the product based on the number of labor hours used at the standard rate of 2.60 per labor hour. Standard costing is the practice of substituting an expected cost for an actual cost in the accounting records.

from www.chegg.com

Fixed overhead is allocated to the cost of the product based on the number of labor hours used at the standard rate of 2.60 per labor hour. It is computed by multiplying. Standard costing is the practice of substituting an expected cost for an actual cost in the accounting records. Standard costing is the cost accounting method that determines the expected cost for each product as a part of production planning or. Assuming that the actual direct. The standard cost is an expected amount paid for materials costs or labor rates. The standard quantity is the expected usage amount of. Let’s begin by determining the standard cost of direct labor for the good output produced in january 2023: The standard cost of direct labor is the total cost of labor required to produce a unit of a product or provide a service.

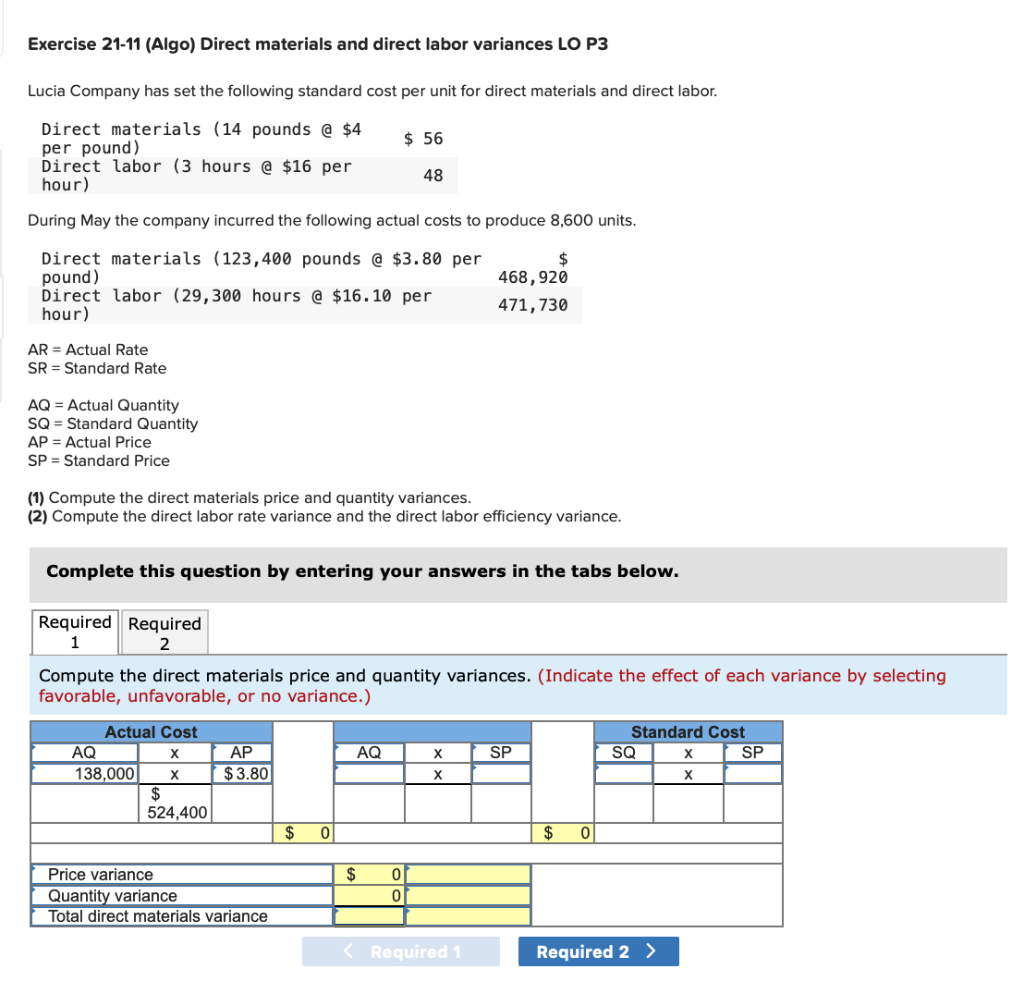

Solved Lucia Company has set the following standard cost per

Standard Cost Labor Rate The standard cost of direct labor is the total cost of labor required to produce a unit of a product or provide a service. The standard cost is an expected amount paid for materials costs or labor rates. The standard cost of direct labor is the total cost of labor required to produce a unit of a product or provide a service. It is computed by multiplying. The standard quantity is the expected usage amount of. Assuming that the actual direct. Fixed overhead is allocated to the cost of the product based on the number of labor hours used at the standard rate of 2.60 per labor hour. Let’s begin by determining the standard cost of direct labor for the good output produced in january 2023: Standard costing is the cost accounting method that determines the expected cost for each product as a part of production planning or. Standard costing is the practice of substituting an expected cost for an actual cost in the accounting records.

From www.chegg.com

Solved Lane Company manufactures a single product that Standard Cost Labor Rate The standard quantity is the expected usage amount of. The standard cost of direct labor is the total cost of labor required to produce a unit of a product or provide a service. It is computed by multiplying. Let’s begin by determining the standard cost of direct labor for the good output produced in january 2023: Assuming that the actual. Standard Cost Labor Rate.

From www.chegg.com

Solved Quality Motor Company is an auto repair shop that Standard Cost Labor Rate Standard costing is the practice of substituting an expected cost for an actual cost in the accounting records. Assuming that the actual direct. The standard quantity is the expected usage amount of. Fixed overhead is allocated to the cost of the product based on the number of labor hours used at the standard rate of 2.60 per labor hour. The. Standard Cost Labor Rate.

From www.restaurant365.com

How To Calculate Labor Costs Key Metrics For Restaurants Restaurant365 Standard Cost Labor Rate It is computed by multiplying. The standard quantity is the expected usage amount of. Standard costing is the practice of substituting an expected cost for an actual cost in the accounting records. Fixed overhead is allocated to the cost of the product based on the number of labor hours used at the standard rate of 2.60 per labor hour. The. Standard Cost Labor Rate.

From www.studyxapp.com

the following labor standards have been established for a particular Standard Cost Labor Rate Fixed overhead is allocated to the cost of the product based on the number of labor hours used at the standard rate of 2.60 per labor hour. Standard costing is the cost accounting method that determines the expected cost for each product as a part of production planning or. It is computed by multiplying. The standard cost is an expected. Standard Cost Labor Rate.

From www.coursehero.com

[Solved] Using the company's activitybased costing system, compute the Standard Cost Labor Rate Standard costing is the practice of substituting an expected cost for an actual cost in the accounting records. The standard cost of direct labor is the total cost of labor required to produce a unit of a product or provide a service. Let’s begin by determining the standard cost of direct labor for the good output produced in january 2023:. Standard Cost Labor Rate.

From www.chegg.com

Solved A manufactured product has the following information Standard Cost Labor Rate Fixed overhead is allocated to the cost of the product based on the number of labor hours used at the standard rate of 2.60 per labor hour. Standard costing is the cost accounting method that determines the expected cost for each product as a part of production planning or. It is computed by multiplying. The standard cost of direct labor. Standard Cost Labor Rate.

From www.chegg.com

Solved The following labor standards have been established Standard Cost Labor Rate Standard costing is the practice of substituting an expected cost for an actual cost in the accounting records. Standard costing is the cost accounting method that determines the expected cost for each product as a part of production planning or. The standard cost of direct labor is the total cost of labor required to produce a unit of a product. Standard Cost Labor Rate.

From www.chegg.com

Solved Lucia Company has set the following standard cost per Standard Cost Labor Rate The standard cost of direct labor is the total cost of labor required to produce a unit of a product or provide a service. The standard quantity is the expected usage amount of. It is computed by multiplying. Assuming that the actual direct. Fixed overhead is allocated to the cost of the product based on the number of labor hours. Standard Cost Labor Rate.

From www.superfastcpa.com

What is a Standard Labor Rate? Standard Cost Labor Rate Standard costing is the practice of substituting an expected cost for an actual cost in the accounting records. The standard cost of direct labor is the total cost of labor required to produce a unit of a product or provide a service. Fixed overhead is allocated to the cost of the product based on the number of labor hours used. Standard Cost Labor Rate.

From www.double-entry-bookkeeping.com

Direct Labor Efficiency Variance Double Entry Bookkeeping Standard Cost Labor Rate The standard quantity is the expected usage amount of. It is computed by multiplying. Standard costing is the cost accounting method that determines the expected cost for each product as a part of production planning or. Let’s begin by determining the standard cost of direct labor for the good output produced in january 2023: The standard cost of direct labor. Standard Cost Labor Rate.

From www.chegg.com

Solved The following information describes a company's Standard Cost Labor Rate Fixed overhead is allocated to the cost of the product based on the number of labor hours used at the standard rate of 2.60 per labor hour. The standard cost is an expected amount paid for materials costs or labor rates. Standard costing is the practice of substituting an expected cost for an actual cost in the accounting records. Standard. Standard Cost Labor Rate.

From davisteparker.blogspot.com

Compute the Standard Direct Labor Rate Per Hour DavisteParker Standard Cost Labor Rate The standard quantity is the expected usage amount of. Standard costing is the practice of substituting an expected cost for an actual cost in the accounting records. The standard cost of direct labor is the total cost of labor required to produce a unit of a product or provide a service. Let’s begin by determining the standard cost of direct. Standard Cost Labor Rate.

From www.template.net

Labor Rate Sheet Template in Apple Numbers, Excel, Word, Pages Standard Cost Labor Rate Standard costing is the cost accounting method that determines the expected cost for each product as a part of production planning or. Fixed overhead is allocated to the cost of the product based on the number of labor hours used at the standard rate of 2.60 per labor hour. The standard quantity is the expected usage amount of. The standard. Standard Cost Labor Rate.

From www.restaurant365.com

How To Calculate Labor Costs Key Metrics For Restaurants Restaurant365 Standard Cost Labor Rate The standard cost is an expected amount paid for materials costs or labor rates. It is computed by multiplying. The standard cost of direct labor is the total cost of labor required to produce a unit of a product or provide a service. The standard quantity is the expected usage amount of. Let’s begin by determining the standard cost of. Standard Cost Labor Rate.

From twitter.com

NSCA on Twitter "Benchmark your labor productivity and calculate Standard Cost Labor Rate Standard costing is the practice of substituting an expected cost for an actual cost in the accounting records. The standard cost of direct labor is the total cost of labor required to produce a unit of a product or provide a service. It is computed by multiplying. The standard cost is an expected amount paid for materials costs or labor. Standard Cost Labor Rate.

From www.chegg.com

Solved Direct Materials and Direct Labor Variance Analysis Standard Cost Labor Rate Standard costing is the cost accounting method that determines the expected cost for each product as a part of production planning or. Assuming that the actual direct. The standard cost of direct labor is the total cost of labor required to produce a unit of a product or provide a service. The standard quantity is the expected usage amount of.. Standard Cost Labor Rate.

From www.bartleby.com

Answered Exercise 106 Direct Materials and… bartleby Standard Cost Labor Rate Assuming that the actual direct. Standard costing is the practice of substituting an expected cost for an actual cost in the accounting records. The standard quantity is the expected usage amount of. The standard cost of direct labor is the total cost of labor required to produce a unit of a product or provide a service. It is computed by. Standard Cost Labor Rate.

From saylordotorg.github.io

Direct Labor Variance Analysis Standard Cost Labor Rate Let’s begin by determining the standard cost of direct labor for the good output produced in january 2023: The standard quantity is the expected usage amount of. Fixed overhead is allocated to the cost of the product based on the number of labor hours used at the standard rate of 2.60 per labor hour. The standard cost of direct labor. Standard Cost Labor Rate.